TransLink 101: Where does TransLink get its funding… and how do we spend it?

TransLink 101: Where does TransLink get its funding… and how do we spend it?

For February 2013, we’re going back to basics with TransLink 101—explaining TransLink and its work!

One of the questions we often hear is, “How are TransLink and the transportation network funded?”

People usually think first of transit fares as one source of revenue, but fares make up just one piece of the revenue pie. So, as part of our TransLink 101 series, we’re looking at TransLink’s existing revenue sources, and where our revenues are spent. Let’s go!

What are TransLink’s existing revenue sources?

Our revenue sources are broad and diverse, which is a benefit because it makes us better able to weather a changing economy, and gives us the capacity to deliver stable and predictable transportation services.

It also comes out loud and clear in our credit ratings – TransLink has maintained an “AA” credit rating even in the face of the financial pressures we’ve faced recently. This means investors, who take into account our revenue sources along with our governance structure and management, rate our organization well and consider our organization stable and well-managed.

There are two main “streams” of revenue that fund TransLink’s services: taxation revenue and user revenue.

Taxation revenue

- Property taxes: TransLink assesses property tax on the net taxable value of land and improvements within the 21 municipalities that make up its service area. Under the legislation, this increases by three per cent each year to keep pace with inflation.

- Fuel taxes: When people fill up their cars in TransLink’s service region, 17 cents of every litre sold goes to TransLink.

- Parking tax: When someone pays for parking in this region – such as at a downtown parkade or a pay parking lot at the university – a tax is included that goes to TransLink.

- Power levy: This is a levy that is added to the hydro bill of residences in Metro Vancouver. It works out to be about $1.90 each month (the maximum).

User fees

- Transit fares: This is pretty self-explanatory – every time you pay to use the transit system, TransLink collects that revenue.

- Bridge tolls: TransLink can collect tolls to recover the costs related to a specific project or major crossing. Right now this applies only to the Golden Ears Bridge.

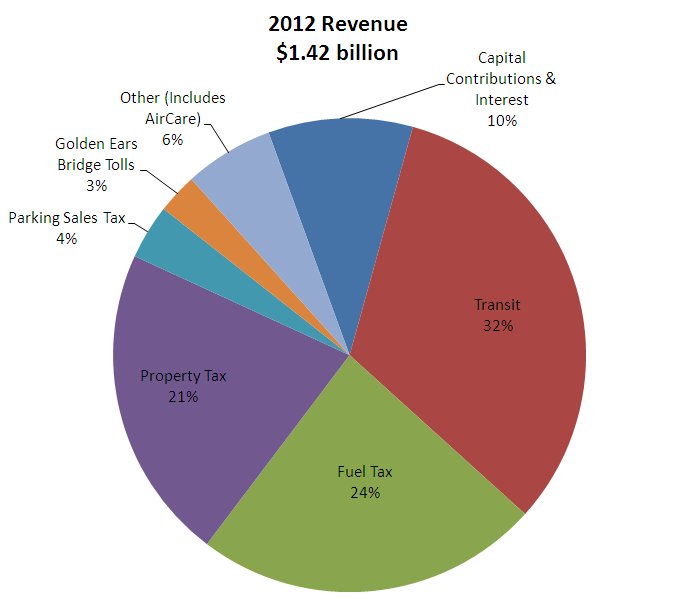

These revenues add up! Our 2012 revenues were $1.42 billion, with the majority of our revenue coming from property tax, fuel tax and transit fares (please note this is an unaudited figure; we haven’t finalized 2012 year-end yet).

Our revenues are outlined in our legislation

It’s worth noting that we can’t just take money from any type of revenue source. TransLink’s funding sources are specifically outlined in the South Coast British Columbia Transportation Authority Act, the provincial legislation that governs TransLink.

Any changes to the revenues TransLink can collect – or how they can be collected – require many levels of approval, typically from the Province, Mayors’ Council, Regional Transportation Commissioner, or some combination of these. They also require a process of extensive consultation with the public and our customers.

Our legislation also includes revenue sources that we don’t currently use. One of these is a vehicle levy, which is a charge on vehicles used in our service region. Although it’s in our legislation, a vehicle levy would only go into effect if the Province tables enabling legislation outlining how such a charge could be collected and protecting privacy.

The second revenue source loosely outlined in our legislation is something called an area benefitting tax. This would be a contribution from property owners who benefit directly from transit improvements. An example of this would be properties integrated with the transit network, such as Plaza 88 at New Westminster Station. However, because it’s essentially a property tax, it could only be put in place in close coordination with the municipalities. It’s not something TransLink is currently exploring.

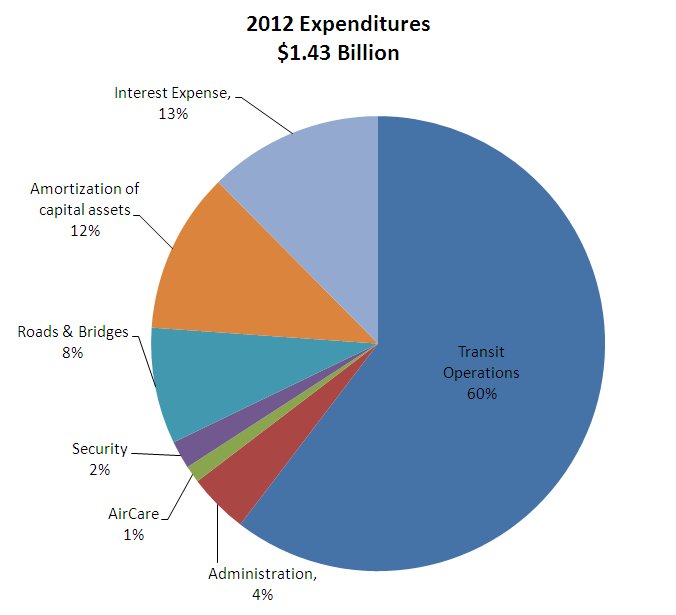

What are TransLink’s expenditures?

Not surprisingly, the majority of TransLink’s expenditures are for transit operations. The keen observer will notice that 60 per cent of our expenditures in 2012 went toward transit operations, while just 32 per cent of total revenues come from transit fares.

Transit fares alone don’t cover the cost of running transit; the other tax dollars that make up the revenue pie – particularly property and fuel taxes – are critical for us to be able to deliver transit service in the region.

The next largest group of expenditures (25%) goes toward debt repayment: interest expense and amortization of capital assets. Like mortgage payments a homeowner might make, this is basically debt repayment for service and infrastructure we already have in place.

Next are our roads and bridges, which make up eight per cent of expenditures; administration at four per cent, which includes information technology costs, planning, finance and human resources; and Transit Police at two per cent.

AirCare operates as “net zero”, meaning the cost of running the program is balanced by the revenue it brings in.

In conclusion

So there you have it – a quick overview of TransLink’s revenues and expenditures! And as we wanted to just give you the basics, there’s much about our finances that we didn’t cover, so your questions are more than welcome in the comments. We’ll do our best to find out the answers for you.

Author: Tina Robinson

Interesting, thanks for posting this. A couple questions:

1) What is the “Capital Contributions and Interest” revenue — does that include payments from other levels of government for capital projects?

2) In the amortization expenses, how much of that is for transit and how much for roads and bridges?

One minor suggestion — I would have grouped fuel tax and parking tax with user revenue, since they are only paid by users of transportation infrastructure, roughly in proportion to use.

Jason: I sent along your questions to our finance team for a response, and here’s what they have sent me.

No more property tax for revenue…. well public transportation should be paid completely by the government from taxes. People should NOT have to pay when they get on the bus. Public transportation is an absolute must . People should not be stranded because they don’t have funds and people shouldn’t have to pay for public transportation to look for work when they have no money. It would also eliminate arguments with bus driver over fares.

Jhen could you find out how the tax rates (on property, fuel, parking, hydro) have changed over time? I know the fuel and parking taxes have gone up, but I’m not sure what they started at. I don’t know if the property tax and hydro rates have changed.

Thanks!

Hi, in your revenue pie chart, is the Power Levy included as Other (Includes Air Care) 6% ?

“Power levy: This is a levy that is added to the hydro bill of residences in Metro Vancouver. It works out to be about $1.90 each month (the maximum).”

When you state for every residences (single homes, condos, townhouse, etc), that does not include any businesses (stores, factories, etc, any place of business)?

Thank you,

Michel lavergne

Hi Michel,

Thanks for your questions. If you check out the 2014 base plan here: http://www.translink.ca/-/media/Documents/plans_and_projects/10_year_plan/2014_base_plan/2014%20Base%20Plan.pdf(specifically page 35), you can see all the details. But in short, the Hydro Levy is included in the ‘other’ category. This is per ‘household account’ which would exclude businesses.

I recall that in the late 1970’s, the Toronto Transit Commission stated that the collection of fares was 30% of their budget. This was when the fares were primarily either cash payments for monthly passes or cash deposited into the fare boxes. Converting to electronic payment systems should have made this part of the business more efficient, but I know the equipment was not inexpensive. I would be interested to know the cost comparison between the current system, and a system with no fares at all