Many of you inquired over the previous few weeks about how funding at TransLink works. One of the most common questions we received were about fares and if they comprise the main source for our revenue.

We’ve pulled together some details, graphs, and data and bring back an updated version of TransLink Funding 101 for everyone who’s curious about the subject!

Diversified approach to funding

As the regional transportation agency, we are responsible for more than just public transport. We maintain major roads and five bridges (Knight Street Bridge, Pattullo Bridge, Golden Ears Bridge, Westham Island Bridge, The Canada Line Bike and Pedestrian bridge), work on developing multi-modal travel in the region, collaborate with our partners on the regional cycling strategy and more.

With our minds focused on spearheading an integrated system for the Greater Vancouver region, we also take a diversified approach to our funding. In short, our funding comes from more than one revenue source. This approach helps us weather changes to economy and minimize the impact of service disruptions or loss of ridership during most critical times so we can continue deliver transportation and operational services. However, with COVID-19, this has become more challenging.

SCBCTA Act has all the answers

The discussion about TransLink’s funding would not be complete without the South Coast British Columbia Transportation Authority Act. This is the provincial legislation that provides formal guidelines for the planning, funding, management and operation of our regional transportation system.

Any changes to the revenues TransLink can collect – or how they can be collected – require many levels of approval, typically from the Province, Mayors’ Council, or some combination of these. They also require a process of extensive consultation with the public and our customers.

Under SCBCTA Act, TransLink develops a 30-year strategy and fully funded, ten-year investment plans (updated at least triennially). While 30-year strategies like Transport 2050, which is under development, provides a bigger picture of how people will live, work, play, and move around the region today and in the future, The 10-Year Investment Plan outlines all the details that determine the funding levels, such as level of services to be provided, major capital projects, estimated revenue, expenditure and borrowing.

What are our main revenue sources?

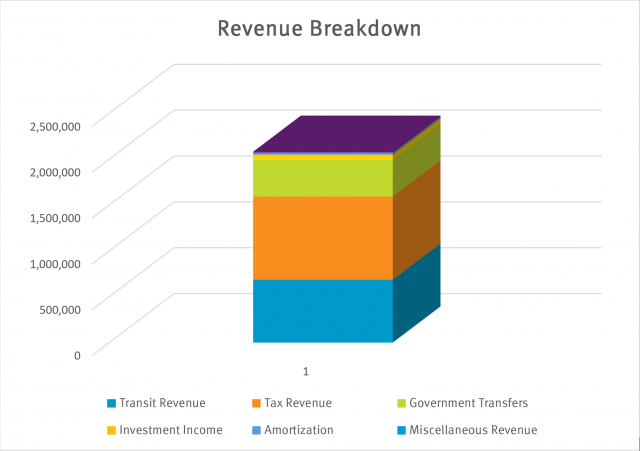

We rely on three main revenue streams that help us deliver our transit and operational services.

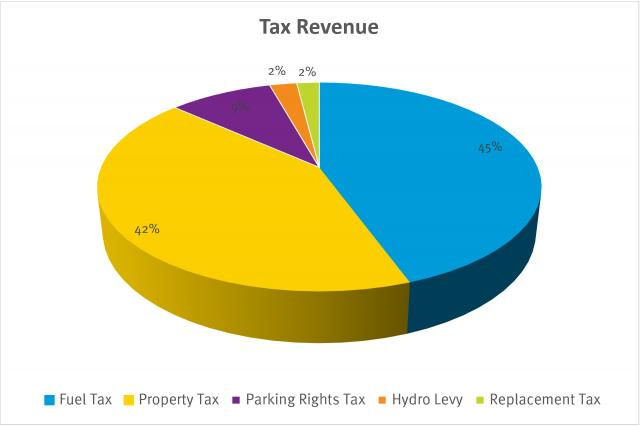

Taxation revenue (44%). This is our largest revenue stream. Although transit revenue covers about 51 per cent of our operating costs, taxation revenue helps supplement the remainder of these costs and a lot more. Sources of taxation revenue include fuel and property tax, parking rights and the hydro levy.

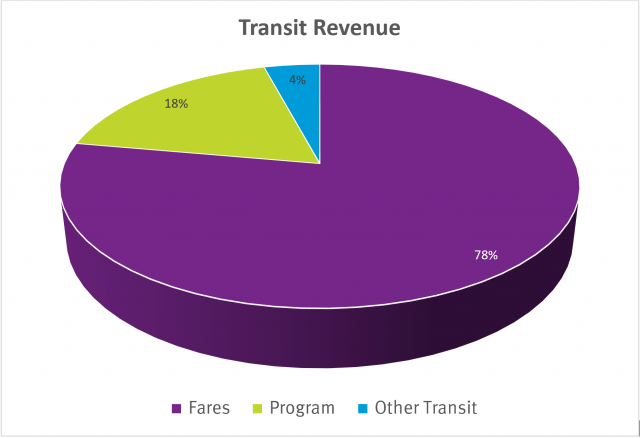

Transit revenue (33%). These are all types of payments that we receive from you whenever you use our transit system or programs such as UPass BC and the BC Government Bus Pass. Revenue from other complementary sources, including transit advertising, Park and Ride and revenue from the sale of carbon tax credits also fall under this category.

Government Transfers (19%). The third largest revenue stream comes from federal and provincial government transfers and helps us to fund major capital projects. This includes funds received from the Federal Gas Tax, Canada Line funding, Building Canada Fund, Public Transit Infrastructure Fund and other miscellaneous programs such as the City of Richmond contributions for Capstan Station.

Other (4%). Other revenue sources include income from investment (interest on sinking funds, capital contributions, debt reserve funds and cash balances) and amortization of deferred concessionaire credit – both of which are not currently available to fund operations.

Figures taken from the 2019 Year-End Financial and Performance Report.

What do property taxes have to do with a transportation agency? And other tax details you might be wondering about.

For those who are not aware, the fact that tax revenues, and not fare revenues, comprise the largest revenue source for TransLink may come as a surprise.

TransLink relies on tax revenues, such as fuel tax and property tax, to continue to create transportation and infrastructure improvements. These initiatives, in turn, positively affect property values, increase travelling options for other modes of transportation and contribute to other complimentary benefits that don’t necessarily fall neatly under “transportation” category.

Fuel Tax. When people fill up their cars in TransLink’s service region, 18.5 cents of every litre sold goes to TransLink.

Property Tax. A portion of property taxes collected in the region is used to support transit, roads and bridges, walking and cycling infrastructure. The majority of property taxes goes to the Province and local municipalities.

Parking Rights Tax. TransLink currently administers parking sales tax for all off-street parking (hourly, monthly, and annually) within TransLink’s service area in Metro Vancouver.

Hydro Levy. This is a levy that is added to the hydro bill of residences in Metro Vancouver.

DCCs. A fee is collected from new developments to help pay for new transit and transportation investments required to support growth.

What are TransLink’s expenditures?

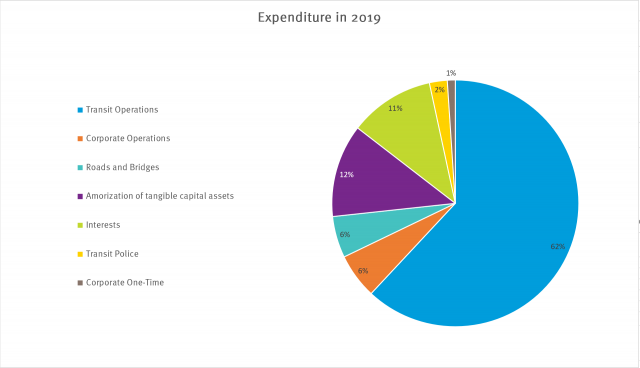

As you can guess, our expenditures are mainly spent on various transit operations and infrastructure maintenance. Below is the expenditure breakdown for 2019:

- Transit Operations. 62 per cent of our budget is spent on transit operations, including rail and bus.

- Amortization of tangible capital assets and interest – amortization is a non-cash expense that allocates the cost of our capital assets over the period the assets are expected to be in use. The cost of capital assets is funded through debt and government funding. Interest expense is incurred to service the debt.

- Corporate operations. about six per cent of our budget goes to corporate operations, such as information technology costs, planning, finance and human resources

- Road and bridges – we spend around six per cent of the annual budget on maintaining roads and five bridges.

- Transit police – part of our expenditure goes to maintaining Transit Police operations. This includes police equipment purchases, as well as vehicle and facility maintenance costs.

- Corporate one time costs – one per cent.

How has COVID-19 impacted TransLink’s revenues?

The outbreak of the pandemic has significantly impacted our operations over the last two months. With most of us staying in, the transit ridership has declined across all the modes in tandem with lower utilization of parking spaces and decreased consumption of fuel. In turn, those changes have also contributed to considerable reductions to our transit, parking tax and fuel tax revenues.

The announcement made by the provincial government and TransLink on May 8th was therefore highly important in giving reassurance to our customers. As the province is gradually unrolling the BC’s Restart Plan, TransLink will resume fare collection on buses on June 1. We will be working on a comprehensive solution to address the major financial impacts to the work TransLink does and will continue to call on the federal government for a national solution to the challenges facing transit systems.

Why is Handydart NEVER mentioned in any Translink’s updates! Is it because it’s contracted out to a For Profit Company?

If Translink is contracted out (as I am sure it is) what are Translink’s responsibilities and authority regarding HandiDART?

After reviewing and researching comprehensive solutions, what conclusions have you reached?