TransLink gives green light to green bonds

TransLink gives green light to green bonds

UPDATE Nov 16, 2018: TransLink issued its first-ever Green Bond, becoming the first transit agency in Canada to do so, helping to satisfy strong investor interest in organizations with a compelling environmental story to tell. The bond, valued at $400 million, is TransLink’s largest bond issuance.

At TransLink, we take environmental stewardship very seriously. We also constantly spend capital to improve our transit network, so YOU, our customers, can benefit from it.

We all know public transit is a greener choice – it takes away cars from the roads, thereby reducing our cumulative carbon footprint.

With this responsibility in mind, TransLink’s Board of Directors has given the green light to issue green bonds as one way to finance the largest expansion to transit service in our region’s history — the 10-Year Vision.

What are green bonds, you might wonder?

Bonds are fixed-income investments where the investor lends money to an entity (typically a government body) by buying a bond that has a fixed rate of return attached to it (unlike the stock market). The entity (called the issuer) in turn uses this money to fund its projects.

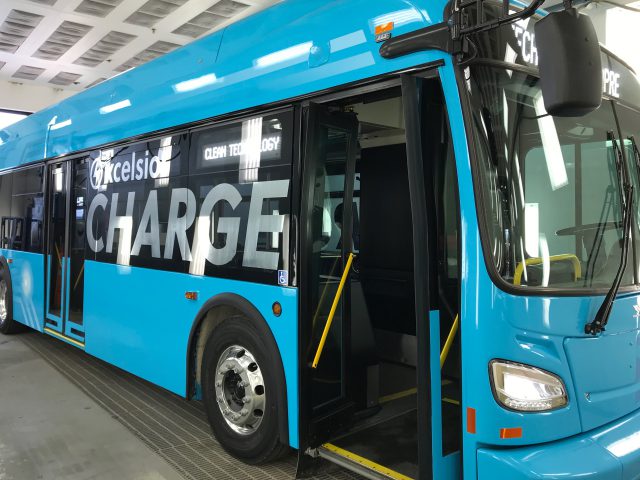

What does this mean for the investor? Our investors are now investing their money that will fund our green projects – for example, battery-electric buses. There’s a keen interest in the investment community to put money into green projects, and bonds help us finance our projects at a low borrowing cost.

Green bonds are similar to conventional bonds — except with the former — investors invest their money in green and low-carbon projects. They are fairly common in Europe and the Canadian capital market is just opening up to the concept, which explains why demand for green bonds is currently high in the investment community.

Since 2010, TransLink has raised funds directly through Canadian debt capital markets (conventional bonds) to finance projects. We will be the first transit agency in Canada to issue green bonds!

Our ridership is growing rapidly and with the largest expansion to transit service in our region’s history, we’re an attractive option for investors seeking an investment with strong, green credentials.

In September 2017, Dominion Bond Rating Service (DBRS) reaffirmed TransLink’s AA stable credit ratings, and in October that year, Moody’s Investors Service and DBRS reaffirmed TransLink’s Aa2 stable credit ratings. Credit rating reports are available at translink.ca.

Pursuing green bonds is about aligning with TransLink’s commitment to sustainability. Last week, the TransLink Board approved a plan to reduce greenhouse gas emissions by 80 per cent and to use 100 per cent renewable energy by 2050.

TransLink is the only non-corporate transit agency that directly raises funds through Canadian debt capital markets to finance capital projects in a timely, efficient manner.

Green bonds will launch in mid-November, subject to market conditions.

If you’d like to know more about Green Bonds, you can visit our TransLink Investor Relations page.

Author: Tanushree Pillai and Chris Bryan

This not only benefits TransLink, but also contributes to the overall effort to reduce carbon emissions and promote sustainable transportation. Continue to do a good job of prioritizing environmental stewardship and using cost-saving services like a time card calculator